Credit Check

Understanding the creditworthiness of potential clients is crucial in today’s business environment. By obtaining credit reports, businesses can assess the credit risk posed by new clients before offering credit terms. These reports provide valuable insights, allowing companies to make informed decisions on payment terms and exercise caution with credit control, thereby offsetting costs against potential bad debts.

As a CreditSafe partner, we offer comprehensive business credit checks for any company in the UK or Ireland, including access to detailed credit reports. Our reports provide valuable insights, including understanding a company’s credit score, and information to help you make informed decisions.

These reports compile information from leading credit reference agencies, ensuring you have access to the most comprehensive data available.

What’s Included:

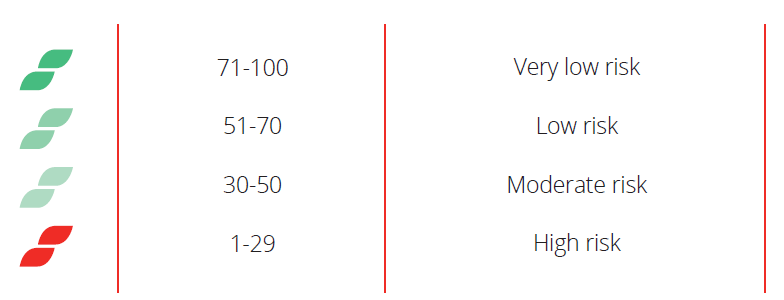

Company Risk Score – The comprehensive assessment encompasses various sub-scores, including financial performance, growth potential, transparency, and product data accessibility, as well as a thorough evaluation of the company’s credit history. This evaluation is conducted on a scale of 0 to 100, reflecting the company’s financial standing and creditworthiness.

Credit Limit – A credit limit is the recommended maximum amount of credit that can be extended to a business, influenced by the company’s credit rating and taking into account other relevant credit management processes. It represents the highest level of credit exposure that is deemed appropriate for that business at any given time.

Business Verification – Verify the authenticity of the company, including its registered information, physical address, and legal standing.

Financial performance – A comprehensive financial analysis provides insights into a company’s growth trajectory and financial stability.

Directors and Shareholders – Confirm the identities of company directors and conduct further consumer verifications, including checking the personal details of directors and shareholders.

Company Ownership – Gain insight into the actual ownership structure of a company, identifying the ultimate beneficial owner.

Key Risk Indicators – Confirm if your customer or supplier has any County Court Judgments (CCJs) or a history of delayed or defaulted payments.